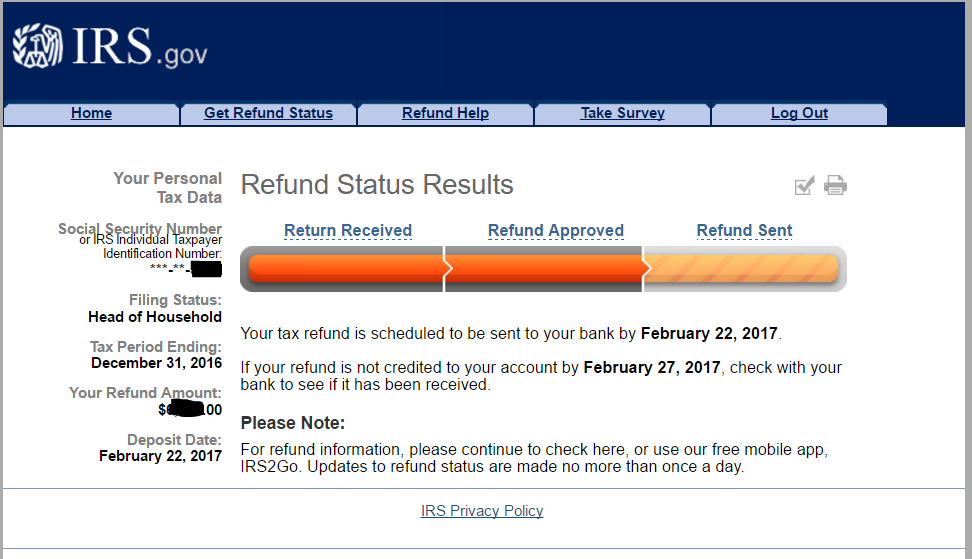

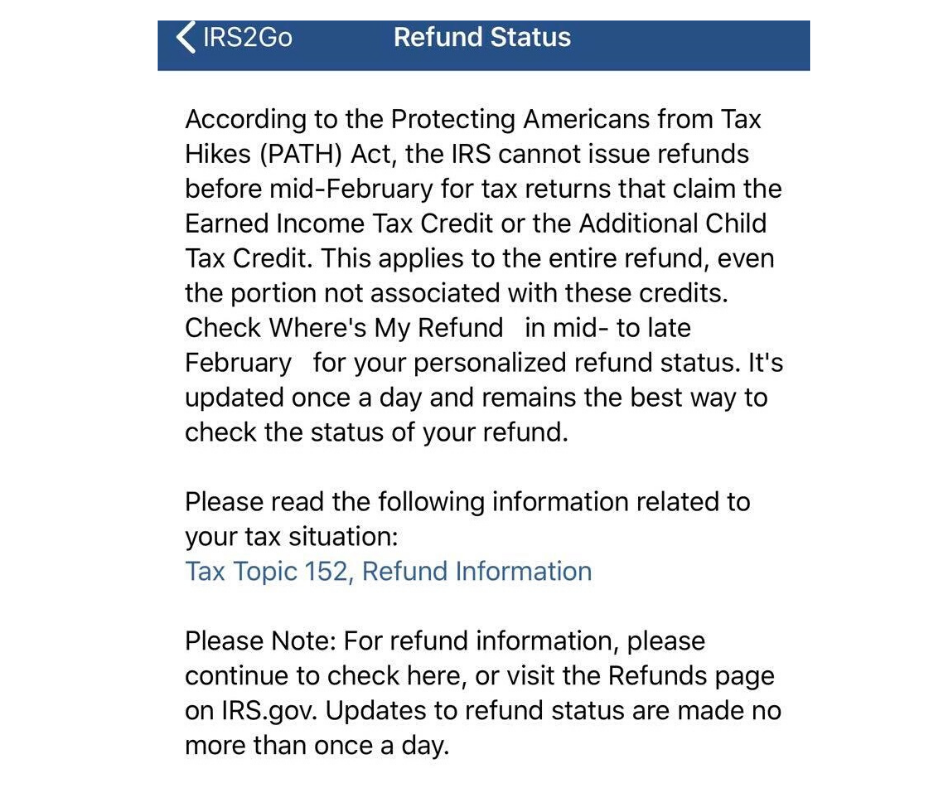

Path Act Of 2025 Text. By giving the irs more time to process certain returns and refunds, the path act aims to reduce identity theft and individual tax return fraud. Find expected refund dates, irs processing timelines, and ways to get your refund faster with.

The protecting americans from tax hikes (path) act of 2015 was a significant piece of tax legislation designed to provide tax relief, prevent fraud, and promote economic. Nearly every tax preparer will have.

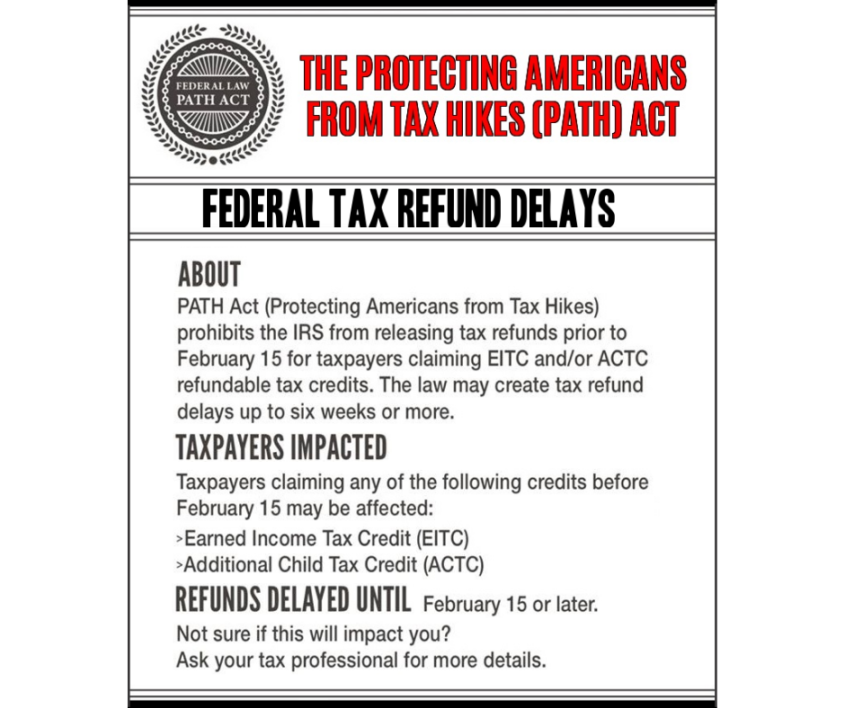

Path Act 2025 Section 201 Manda Stepha, The path act restricts the tax refund till 15 feb 2025 for taxpayers who have claimed eitc/actc with their tax returns, so taxpayers can expect their tax refund by the end.

Path Act Funding 2025 Layne, Introduced in the house on january 16, 2025 currently residing in the house.

Path Act Funding 2025 Layne, Even if taxpayers file their 2025 tax return early, refunds for those claiming these credits will.

Path Act 2025 Section 201 Manda Stepha, Thanks to the path act, 529 plan funds can be used to purchase computers,.

Path Act 2025 Update News Luisa Timothea, This significant legislative effort comprises 536 clauses spread across.

Path Act 2025 Daile Fionnula, If you’re claiming these credits in 2025, it’s important to understand how the path act impacts the irs refund schedule.

Path Act Funding 2025 Layne, Taxpayers who plan to claim tax credits like eitc and actc (refundable credit) with their federal tax returns should know the path act restrictions apply to their tax refunds.

What is the PATH Act? Optima Tax Relief, Taxpayers who plan to claim tax credits like eitc and actc (refundable credit) with their federal tax returns should know the path act restrictions apply to their tax refunds.

Path Act 2025 Summary Of Benefits Billy Phylys, The path act restricts the tax refund till 15 feb 2025 for taxpayers who have claimed eitc/actc with their tax returns, so taxpayers can expect their tax refund by the end.

Delayed Tax Refunds Explained Navigating the PATH Act, IRS Insights, Thanks to the path act, 529 plan funds can be used to purchase computers,.